Stop Playing "Fair" Games

Stop trying to beat the public market. The people with the most money have already stopped trying.

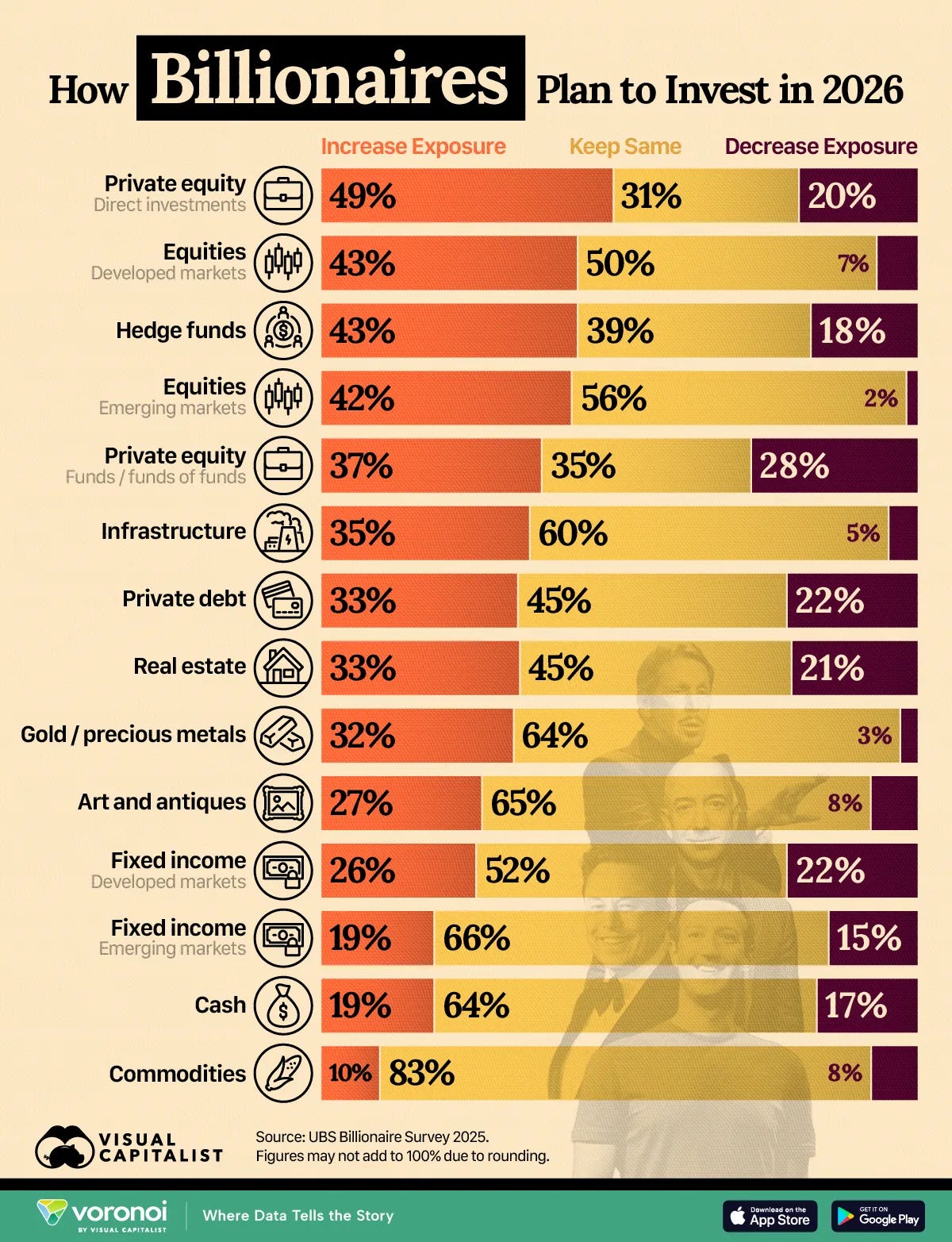

If you look at where billionaires are moving their capital for 2026, the signal is deafening.

They are leaving the “fair” games.

According to UBS data, nearly half (49%) plan to increase exposure to Private Equity. 43% are doubling down on Hedge Funds.

Why?

Because public markets have become too efficient. Between high-frequency trading, AI analysis, and instant global information, the “edge” in picking stocks is effectively zero.

When everyone has the same data, no one has an advantage.

Billionaires are shifting capital to where markets are still inefficient: private deals, distressed assets, and complex derivatives.

In these spaces, information asymmetry still exists. In these spaces, relationships still matter more than algorithms.

The lesson for founders and operators isn’t to go buy a hedge fund. It’s to stop playing games where you have no leverage.

If you are competing in a market where information is perfect and accessible to everyone, you are competing on price. That’s a race to the b…